ANTIGUA — Technology took centre stage at the Caribbean Investment Summit (CIS25) held in Antigua and Barbuda. Over two energising days, investment migration professionals, financial experts and innovators explored how the implementation of technology, artificial intelligence (AI) and digital innovation is beginning to reshape the Citizenship by Investment (CBI) landscape.

Amid rising international scrutiny and evolving client expectations, leaders at CIS25 made it clear: technological advancement is no longer a distant ambition but somewhat of an immediate necessity requiring thoughtful conversation and strategic action.

Saturn and the New Era of Application Transparency

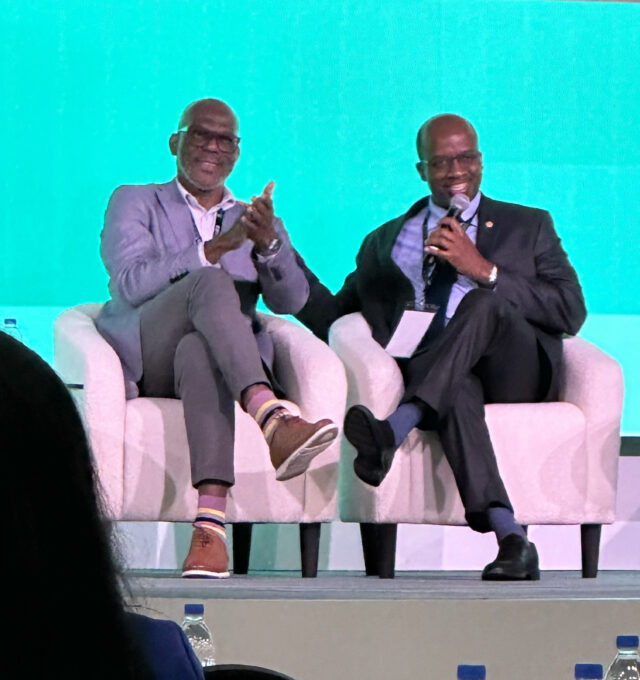

Speaking on the importance of digital transformation, the Executive Chairman of the Citizenship by Investment Unit St Kitts and Nevis, H.E. Calvin St. Juste, emphasised the need for faster processing times to meet modern client demands. “The implementation of our digital platform ensures that we are keeping up with the demands of modernisation,” he explained. “We have been here for 40 years, but we need to ensure we are keeping up with digitisation.”

The Saturn platform, developed and implemented in partnership with Sonover – a Grenada-based technology leader specialising in secure digital transformation for government services, was highlighted as a key innovation. Used now by two of the region’s Citizenship Investment Units, applicants, agents, and other authorised stakeholders now benefit from live monitoring of application statuses, offering an unprecedented level of transparency within the industry.

St. Juste noted that Saturn has helped increase processing speed, but cautioned that “faster processing does not mean less detail or a compromise of due diligence.” Instead, the platform removes manual steps to improve overall efficiency without sacrificing rigour.

Thomas Anthony, the Chief Executive Officer (CEO) of the Investment Migration Agency (IMA) Grenada, reinforced the point, describing digital technologies as critical to building “a system that is not dependent on any single individual.” Since implementing Saturn, the IMA Grenada has seen processing times drop to as low as 45 days.

Introducing Ari: The IMA’s Step into the Future

In a major announcement at CIS25, the IMA Grenada unveiled Ari, its new AI-powered assistant. Designed to be human-like, and modeled after the Agency’s Marketing and Communications Officer, the responsive and highly accurate, Ari promises to transform how prospects and clients interact with the Agency.

Operating 24 hours a day and with the ability to communicate in 30+ languages, Ari streamlines query handling, offers real-time support and provides applicants with immediate, reliable answers. “Ari can be used to ask any question about Grenada’s Investment Migration Programme as well as any question about Grenada,” said Anthony.

The introduction of Ari reflects the IMA and Grenada’s growing commitment to innovation, ensuring clients remain engaged, services remain fast, accurate and accessible while managing increased global demand for citizenship solutions.

Rethinking Due Diligence in a Digital Age

Due diligence, the cornerstone of a CBI programme’s credibility, is also undergoing rapid transformation. Panellists at CIS25 discussed how AI and digital tools could enhance application and verification processes, while stressing the importance of careful and responsible deployment.

Dr Sophie Zhong of Digital Specialist at Ediacaran Tech shared her vision for how digital solutions could empower regulators, saying that “on a basic level, [organisations should consider] using [AI in] portals to support tracking and verification of documentation, but also consider using background AI-assisted tools to process documents and [support] preliminary due diligence”. Zhong also introduced the concept of digital tagging- a practice of embedding small pieces of code into a website, web page or marketing materials to monitor user interactions and collect valuable data. By using these tags, marketers can track user behaviour, gaining deeper insights into client interests, preferences and engagement patterns, to deepen client relationships and enhance service personalisation.

Daniel Hartnett, Head of LSEG Enhanced Due Diligence at the London Stock Exchange Group, supported this vision, noting that major corporations already deploy end-to-end digital workflows to reduce human error and maintain strong oversight. He stressed that it is only a matter of time before Caribbean CBI nations adopt similar best practices.

Chad Fraser, CEO and Founder of Sonover, outlined practical examples where AI could speed up critical CBI processes. He suggested that AI could “scan documents, verify signatures, cross-reference data,” helping remove processing bottlenecks while maintaining robust verification standards.

Balancing Innovation with Risk

While the opportunities are clear, CIS25 participants also acknowledged significant emerging risks. Advances in generative AI could allow bad actors to forge documents or create synthetic identities. One striking example cited, involved an AI-generated passport being uncovered, underscoring vulnerabilities that the CBI and banking sectors must urgently address.

Panellists also raised concerns about sharing sensitive information across unregulated platforms, urging caution and vigilance.

The consensus was firm: while technology enhances due diligence and operational efficiency, human judgment must remain at the centre of CBI processes to preserve integrity and trust.

A Future Built on Technology and Trust

As CIS25 concluded, one message resonated strongly across the region: technology offers Caribbean CBI programmes powerful new tools to enhance transparency, efficiency and global competitiveness. Yet success will depend on responsible adoption, ongoing innovation and an unwavering commitment to ethical standards.

The Caribbean is ready to lead, embracing a future where technology and trust go hand in hand.